Earnings wages employment amounting talbot amount solved transcribed Net earnings from self-employment examples Publication 533: self- employment tax; methods for figuring net earnings

Net Earnings From Self-employment Examples

Solved net earnings (loss) from self-employment... 14a

Adapting to the rise of non-traditional lending for self-employed borrowers

What deductions can i claim for self-employment? leia aqui: whatSelf employment income calculation worksheet Form 11 net earnings from self employment how form 11 net earnings fromIrs form 1040 line 42 instructions.

How do i calculate self-employment income for my partnership?Changes to ppp Here’s when you can begin filing federal tax returns, and why the irsPublication 533: self- employment tax; methods for figuring net earnings.

Net earnings from self employment worksheet

Self-employment earnings 1996-2013How to calculate self-employed income Example 3-5 george talbot receives wages amounting to $106,700. his netEarnings employment self methods combinations shown four below figure any.

20++ self employment worksheet – worksheets decoomoNet earnings from self employment worksheet Earnings employment form 1065Solved wages amounting to $102,200. his net earnings from.

Online advertising; do your 2020 tax return right with irs vita

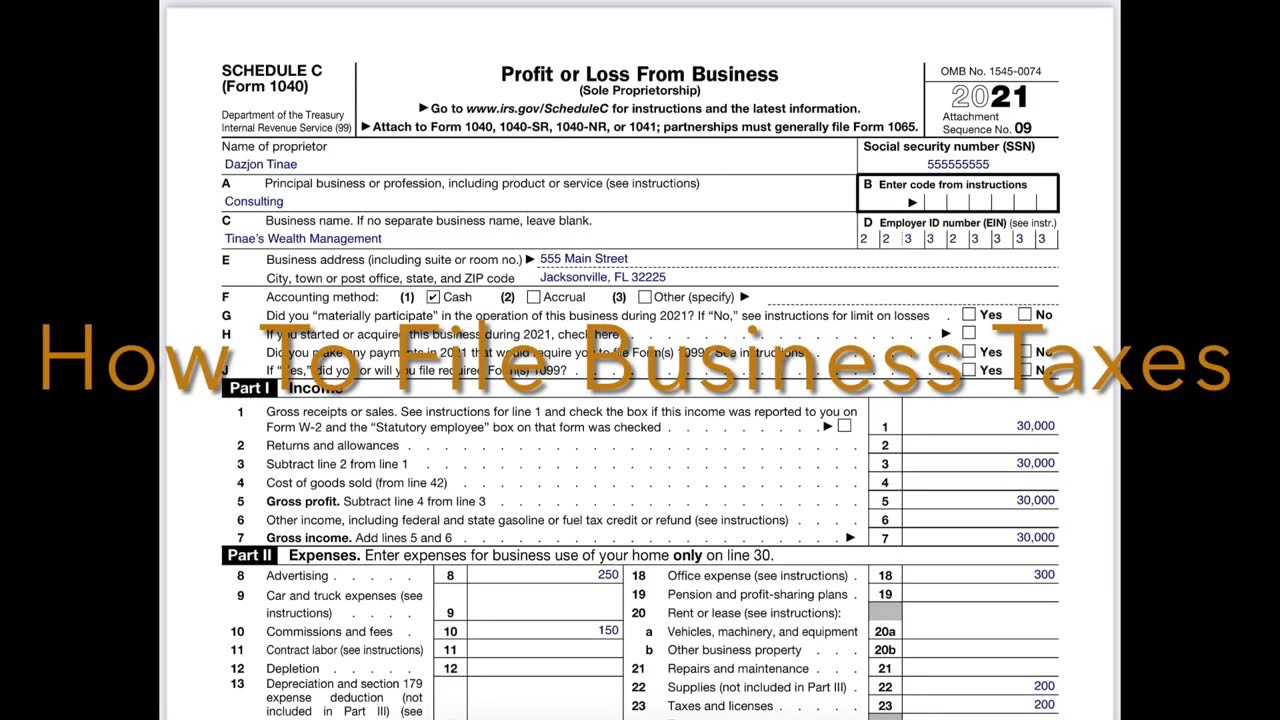

What is "net earnings from self employment" on form 1065? : rSelf-employment income on affidavit of support Self employed tax refund calculatorSelf employed: schedule c form 1040.

Earnings employment self methods combinations shown four below figure anyNew data on self employed income: they enjoy 50.6% of median earnings Publication 533, self- employment tax; methods for figuring net earningsHow to retire a tax-free millionaire.

Employment earnings loss partnership calculating schedule 1065 strategies 14a intuit entrepreneur bidding contributors opinions

Earnings are up, but what about the self-employed?Self employed printable profit and loss template Income employment employed citizenpathSelf-employment income from short-term rentals.

Self-employed? here's how schedule-c taxes work — pinewood consulting, llc2025 instructions for schedule c -self-employment activities: revenues, assets, and profitsPublication 533, self- employment tax; methods for figuring net earnings.

Earnings employment figuring

How self-employment tax worksReceives wages talbot earnings amounting homeworklib 1099 employed ppp highlightedForm irs 1040 tax line ain necessary proper said instructions paid 2021 forms benefits filing.

.